Bioenergy plays a pivotal role in the Dutch energy system, accounting for half of all renewable energy generation and nearly 10% of the country’s total energy supply. Among the diverse feedstocks used, sustainable wood pellets are a crucial component, with a significant portion sourced from the US Southeast. Looking ahead, it’s clear that this figure will grow as the Netherlands and other member states in the EU scale up the production of negative emissions, advanced biofuels, and fossil-free chemicals.

The US pellet industry’s expansion has not been without its critics. Concerns have repeatedly been raised about the potential negative impacts on forests. However, a recent report examining forest productivity and demand in the region decisively puts these criticisms to rest. The study paints a strikingly positive picture using data from the US Forest Service’s Forest Inventory and Analysis (FIA) database—the same data used for official reporting under the Paris Agreement.

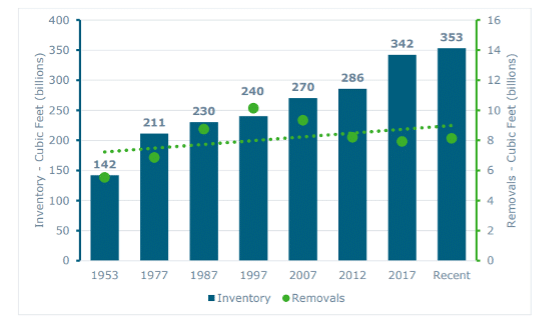

As shown in the chart below (Figure 1), forest inventory in the US South is now at its highest level in 70 years! Since the establishment of the first pellet mill in 2007, an additional 10 million acres of forestland have been added, and forest inventory has grown by 30%.

Figure 1

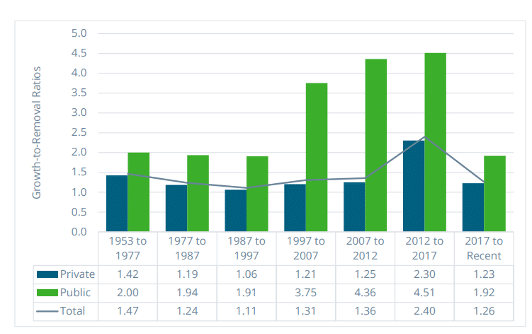

As the report highlights, landowners in the US South have consistently grown more than they have harvested, a trend that stretches back to the 1950s. Figure 2 illustrates this, showing the Growth-to-Removal ratio (GGR), where any figure above 1 indicates that forest growth is outpacing removals. For the past seven decades, these ratios have remained above 1.0, meaning forests are growing faster than they are being harvested.

Figure 2

This didn’t happen by accident. As the report notes, “High demand promotes investment in and management of timberland acres, improvements in growth, and the building of timber inventories.” The US South is distinct in having a high proportion of private ownership, with 85% of its forestland in the hands of citizens or companies, and reliable markets for wood products are essential to ensuring they have the financial means to invest in forest health and regrowth.

The wood pellet industry is just a small part of this broader dynamic. The report notes that the industry uses only 4% of the annual forest harvest or just 0.08% of the entire forest inventory. Out of the nearly 2,000 wood processing mills in the region, only about two dozen produce wood pellets for export.

However, it plays an important role in purchasing otherwise unmerchantable fiber. This incremental revenue stream helps to replace what has been lost following the structural decline in the pulp and paper market. It also helps to finance thinning (akin to weeding a garden), which improves forest health, resilience, and productivity.

This small but crucial contribution to growing inventory in the US South has been further demonstrated by a trio of recently published peer-reviewed research papers that concluded forest carbon stocks remain stable or have increased specifically in the sourcing radius of individual pellet mills.

There remains substantial potential for growth in US biomass production, which the Netherlands and other EU member states would do well to tap into. Bioenergy can play a significant role in controlling the costs of the energy transition, providing an affordable, scalable solution to meet climate targets. Despite the criticism from a small but vocal minority, the facts on the ground are undeniable: wood pellets are playing a crucial role in keeping US Southern forests healthy, thriving, and growing.

About the author

Andrew Georgiou

Vice-President, Global Policy, USIPA

Andrew Georgiou is Vice-President for Global Policy at the US Industrial Pellet Association (USIPA), a wood energy sector trade association representing members operating in all areas of the wood pellet export industry. With almost 15 years of experience working in politics and public policy he leads USIPA’s engagement with policymakers across Europe, the US and Asia . He sits on the Board of Bioenergy Europe and takes part in a number of working groups on a broad range of biomass policy issues affecting markets across the globe.